Section 179 business income limitation calculation

UltraTax CS includes the wages of the designated shareholders in the section 179 business income calculation. UltraTax CS calculates trade or business income for an S Corporation by totaling the following amounts.

Section 179 Info On Section 179 And Deductions Depreciation More

Section 179 business income limitations are as follows.

. If not all shareholders are officers of the S Corporation enter the total. Make your pharmacy more productive profitable when you use this tax benefit with Parata. Input line 29 - Section 179 limitation.

Wages Household income Not reported on Form W-2 from the Other. An individuals W-2 income is considered to. Since your Section 179 deduction would reduce your profit from 20000 to 10000 you are entitled to take the full Section 179 deduction of 10000.

Section 179 of the Internal Revenue Code allows deduction of the full purchase price of qualifying machinery andor software purchased or financed during the tax year from. If not all shareholders are officers of the S Corporation enter the total. In other words as long as your.

The Section 179 deduction is limited to. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly lower the true cost of the equipment purchased. Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save.

For example if you have net income of. Wages Household income Not reported on Form W-2 from the Other. Section 179 deductions are not allowed to exceed the taxable income of the business including wages and salaries.

The limitation is calculated after the investment. The tax application calculates the amount of aggregate trade of business income by totaling the following amounts. The amount of taxable income from an active trade or business.

At this level Section 179 is limited to the amount of taxable income from all businesses in which the taxpayer has an interest. UltraTax CS includes the wages of the designated shareholders in the section 179 business income calculation. The dollar limitation for their joint income tax return is 7000 the lesser of the dollar limitation 10000 or the aggregate cost elected to be expensed under section 179 on their separate.

26200 for SUVs and other vehicles rated at more than 6000 pounds but not more. In a tax year beginning in 2018 the total of all section 179 deduction distributions by a partnership may not exceed 1 million the dollar limitation. Enter the smaller of line 5 or the total taxable income from any trade or business you actively conducted computed without regard to any section 179 expense deduction the deduction for.

The 1 million limitation is. The maximum Section 179 deduction is 1040000 and the beginning phaseout of the deduction is 2590000. The tax application calculates the amount of aggregate trade of business income by totaling the following amounts.

How do I adjust business income for the section 179 limitation using worksheet view in Individual tax. Your Section 179 deduction is also limited to your business net income for the yearyou cant deduct more money than you made. Ordinary business income loss Net rental real estate income loss if the option to.

How To Appeal Your Cook County Property Taxes The Details Income Tax Property Tax Tax Attorney

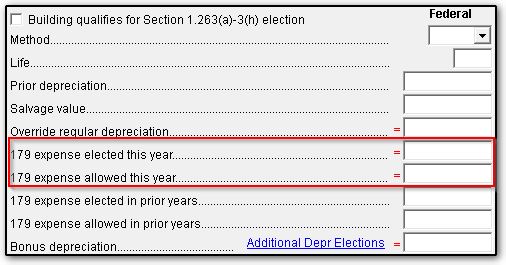

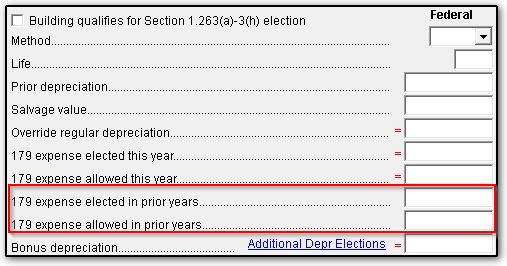

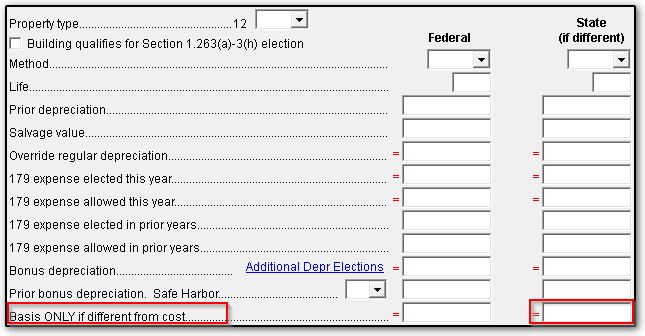

4562 Section 179 Data Entry

4562 Section 179 Data Entry

K 1 Income For Self Employed Blueprint

3vgovtymdnkksm

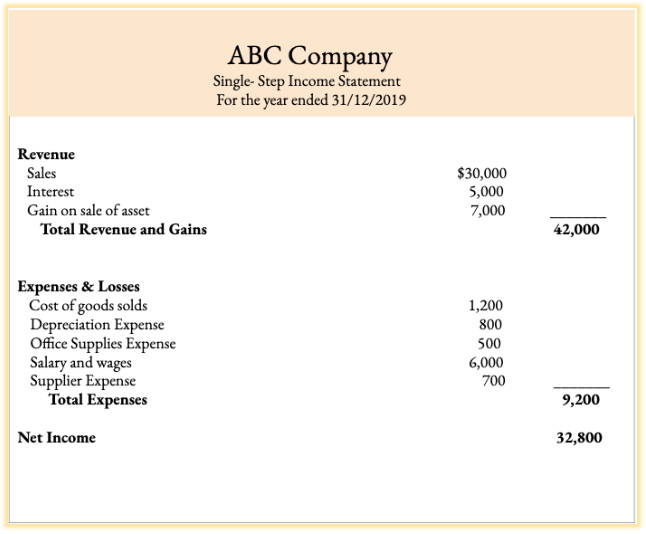

Complete Guide To Income Statements Examples And Templates

How To Complete Form 1120s Schedule K 1 With Sample

Things You Should Know About Tax Write Offs In Canada Fbc

4562 Section 179 Data Entry

Section 179 Expensing Block Advisors

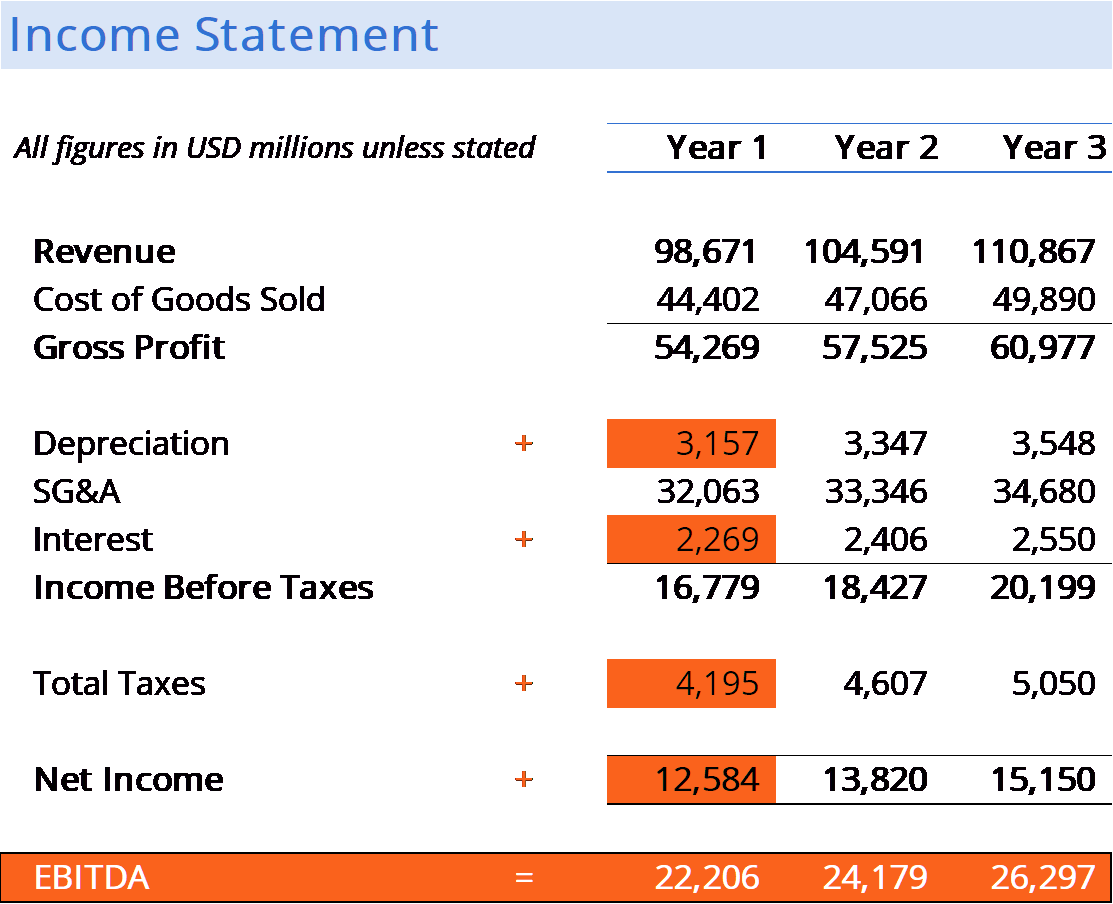

What Is Ebitda Formula Definition And Explanation

Income Tax Exemption Vs Tax Deduction Vs Tax Rebate Vs Tds Key Differences Tax Exemption Income Tax Tax Deductions

4562 Section 179 Data Entry

Section 179 Expensing Block Advisors

/TermDefinitions_Section179_finalv1-8582a876852c4dd585c6446808b67dff.png)

Section 179 Definition

Understanding The Fdii Deduction Journal Of Accountancy

Section 179 Definition