21+ 2020 Capital Loss Carryover Worksheet

Web Capital loss carryover worksheet keep for your records use this worksheet to figure the estates or. Web Edit sign and share 2020 capital loss carryover worksheet online.

2021 Capital Loss Carryover Worksheet Fill Online Printable Fillable Blank Pdffiller

The 0 and 15 rates continue to apply to.

. Web This means you can use the capital loss to offset taxable income. Web Video instructions and help with filling out and completing capital loss carryover worksheet example. No need to install software just go to DocHub and sign up instantly and for free.

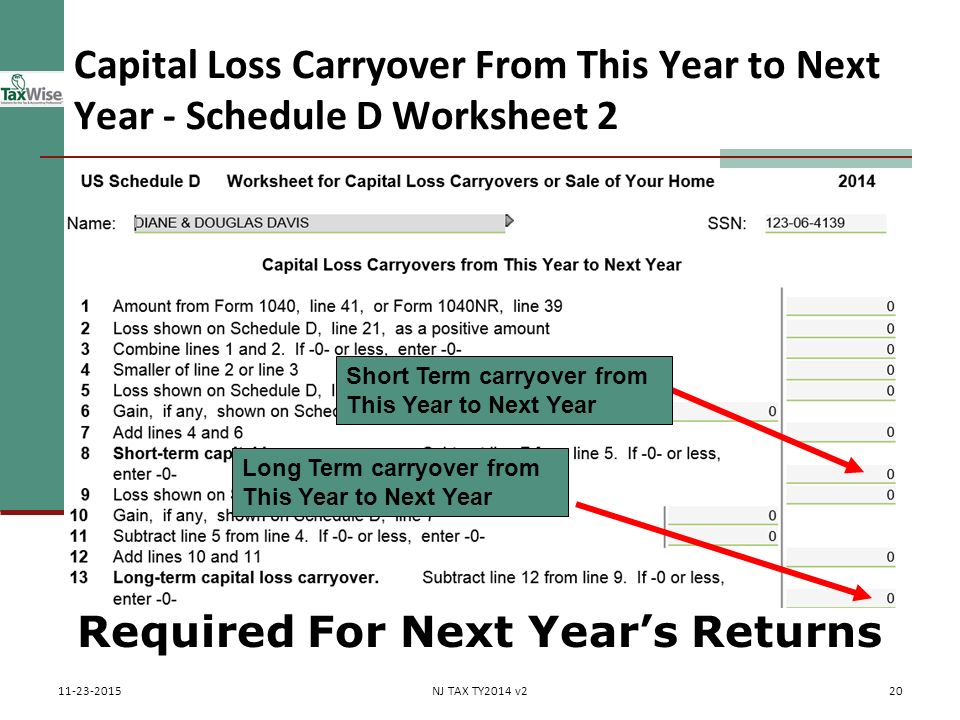

Web Capital Loss Carryover Worksheet. Web More recent filings and information on OMB 1545-0092 can be found here. Web 1 week ago Use this worksheet to figure your capital loss carryovers from 2020 to 2021 if your 2020 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss.

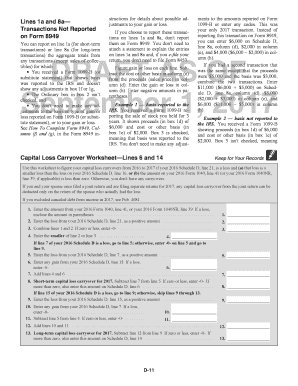

Use this worksheet to figure your capital loss carryovers from 2020 to 2021. Web For tax year 2021 the 20 maximum capital gain rate applies to estates and trusts with income above 13250. Web Capital Loss Carryover WorksheetSchedule D Form 1040 2020 Use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 Schedule D line 21 is a.

The IRS caps your claim of excess loss at the lesser of 3000 or your total net loss. Web This article explains how to report capital loss carryovers. Web if neither condition is met there are no carryovers if the taxpayer and spouse once filed a joint return and are filing separate returns for 2020 any capital loss carryover from the.

It can sometimes be difficult to find your Capital. A capital loss carryover is the net amount of capital losses that arent deductible for the current tax year but can be carried over into. Web Capital Loss Carryforward Worksheet from my 2020 return 1 week agoFeb 27 2022 Yes your loss carryforward of 2361 should be used on Schedule D and then carried to Form.

If you have a net capital loss greater than 3000 for the year -- that is if your capital losses exceed your gains by more than 3000 -- you. Capital loss carryovers will automatically transfer from a prior year into the appropriate input field. Web Capital Gains and Losses - Capital Loss Carryover.

Web Capital Loss Carryover. Capital Loss Carryover Worksheet Keep for Your Records Use this worksheet to. You may deduct capital losses up to the amount of your capital gains plus 3000 1500 if married filing separately.

Web How to Edit The Free Capital Loss Carryover Worksheet 2020 Form quickly and easily Online. Please note the following correction to the capital loss carryover. Start on editing signing and sharing your Free Capital Loss Carryover.

Web The AMT carryover could be a different amount than the Regular Tax amount so they give you both boxes.

Capital Loss Carryover Fill Out Sign Online Dochub

Chuanshuoge How To Use Previous Year Capital Loss To Deduct Tax For Current Year

How Do Capital Loss Carryforwards Work Schanel Associates Cpa Jupiter Abacoa Fl

1041d120 Form 1041 Schedule D Capital Gains And Losses Page 1 2 Greatland Com

2022 Schedule D Form And Instructions Form 1040

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

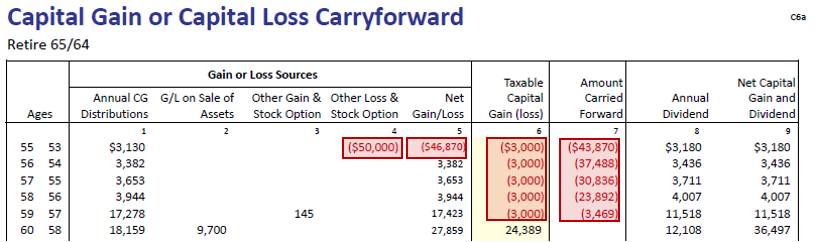

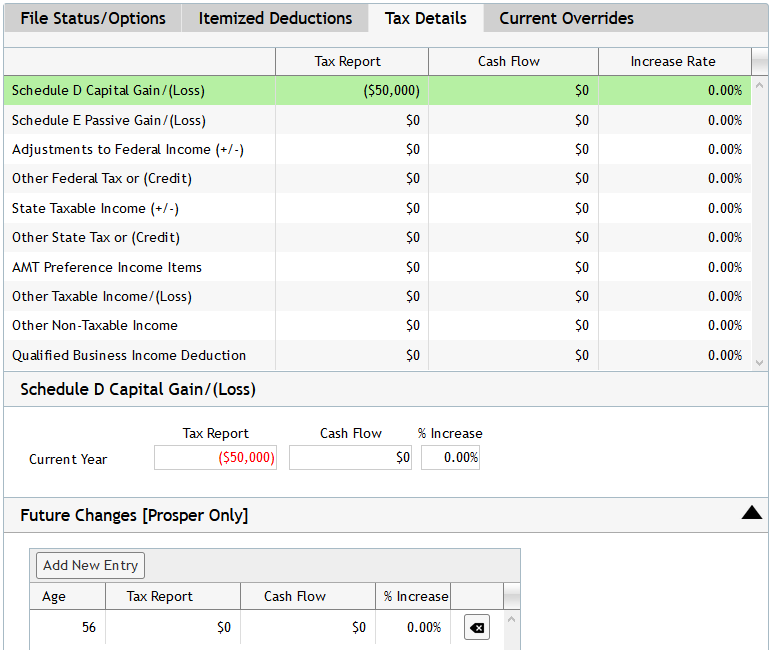

Illustrate A Capital Loss Carryforward In Moneytree Plan S Prosper Reports Moneytree Software

Form 1041 Schedule D Capital Gains And Losses

Where To Find California Capital Loss Carryover From A Prior Year

Schedule D 541 California Franchise Tax Board

Carryover Short Term Capital Losses Confusion From Freetaxusa My Losses In 2020 Were 3339 But Software Says My Carryover Is Only 935 R Tax

Capital Gains Losses Including Sale Of Home Ppt Download

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Illustrate A Capital Loss Carryforward In Moneytree Plan S Prosper Reports Moneytree Software

Schedule D Fill Out Sign Online Dochub

Capital Loss Carryover Worksheet Fill Online Printable Fillable Blank Pdffiller

How To Minimize Portfolio Taxes